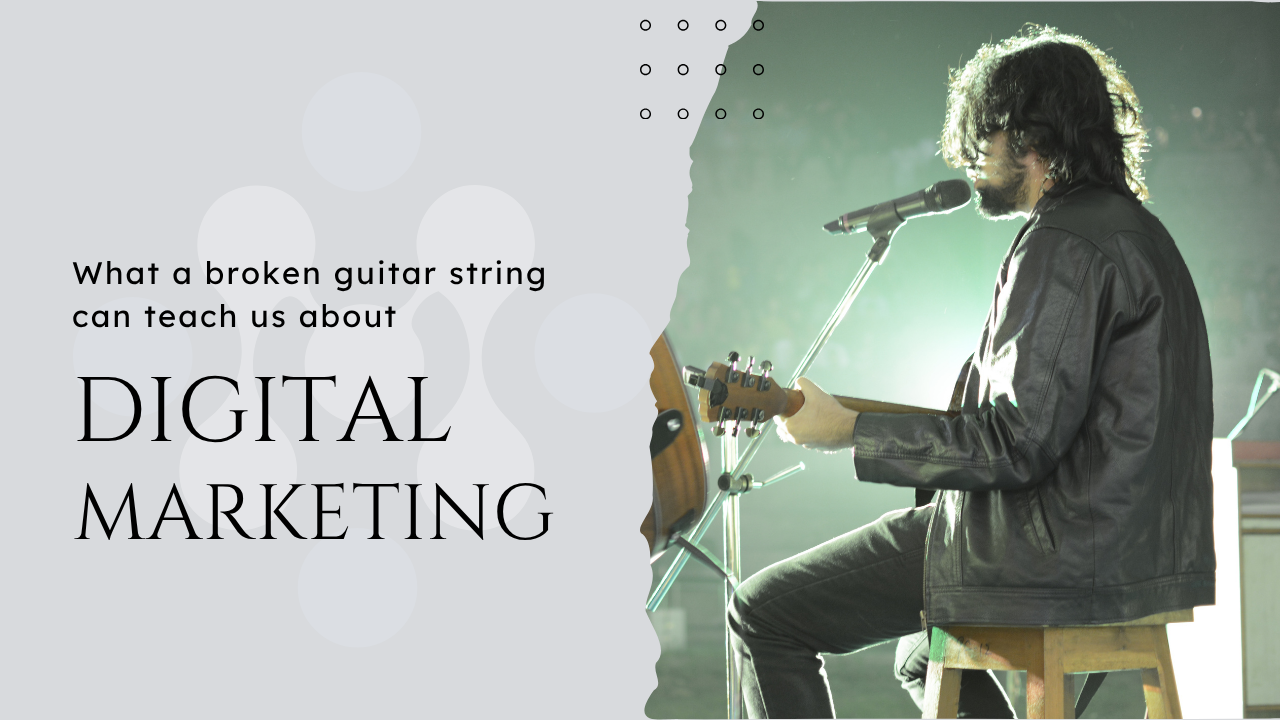

What can a broken guitar string teach us about Digital Marketing?

A snapped string. A live audience. And a guitarist who didn’t miss a beat. This moment inspired a new approach to digital marketing—where your business shows up everywhere, even when something breaks. If you’ve ever lost leads from a Google glitch or content delay, this is your blueprint for visibility that lasts.